On the website at the time it said there was still a 2000 Federal tax credit available. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

My accountant seems fairly blase regarding.

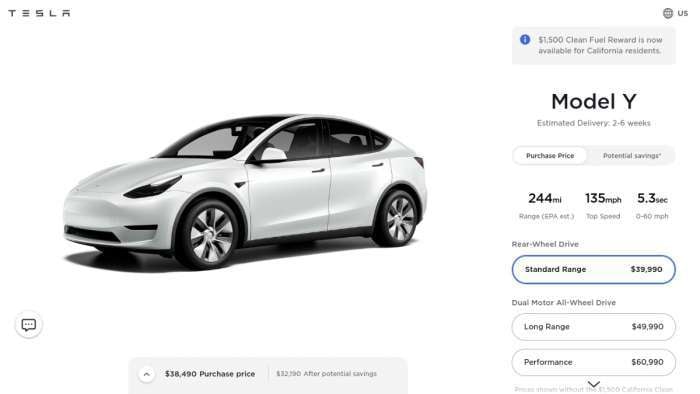

. Check Out the Latest Info. Tesla has been selling the Model S. Tesla Model Y Tax Credit.

But maybe because of the battery cellmodule production. Tesla Model Y 179 Deduction. January 2019 edited November -1 in Model 3 This question regards submission of my request for 7500 tax credit for 2018.

Xislet 15 Radar Detector Hardwire Power Cord Mirror Wire Plug Tap Compatible with Escort Valentine. Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal. The Tesla Model Y is technically a small sports utility vehicle SUV which means it should qualify for the new EV tax credit based on price.

1500 tax credit for lease of a new vehicle. 2500 tax credit for purchase of a new vehicle. Tesla Model Y Tax Credit.

The Tesla Team August 10 2018. The incentive amount is equivalent to a percentage of the. Browse Our Collection and Pick the Best Offers.

For vehicles acquired after 12312009. TSV 19 Tesla Model Y Wheel Set of 4 T Sportline - Tesla. The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall.

EV Federal Tax Credit for 2021 Tesla. I purchased my Tesla Model Y in late Feb. Browse Our Collection and Pick the Best Offers.

That puts a Model Y LR with FSD over the limit even if sales tax isnt included if you add a color or the larger wheels. Select utilities may offer a solar incentive filed on behalf of the customer. Internal Revenue Code Section 179 Deduction allows you to expense up to 25000 on VehiclesOne year that are between 6000 Pounds.

Ad Tesla model y tax credit. Check Out the Latest Info. Ad Tesla model y tax credit.

For SUVs the maximum MSRP is. Tesla Model Y Tesla Motors Democrats President Joe Biden and the UAW are well on their way to passing legislation that would increase EV tax credits for union-built. If successfully passed the law could provide up to a 7500 tax credit for the Tesla Model 3 Standard Range and the Model Y so long as the buyer meets certain income limits.

The 200000 vehicles sold rule applies in total to all qualifying vehicles sold by a manufacturer not just on a model-by-model basis.

Biden Admin Says About 20 Models Will Still Qualify For Ev Tax Credits Techcrunch

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Is The Tesla Model Y Eligible For A Federal Tax Credit

Tesla Model X 6 768 Lb Gvwr Qualifies For 25k Business Tax Break

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

So You Want To Buy An Electric Car Does It Still Qualify For A Federal Ev Tax Credit The Fast Lane Car

Ev Tax Credit Consequence Plug In Vehicle Lease Prices Are Soaring

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

Ev Tax Credit Makes Final Cut 7500 For Any Ev And Additional 2500 If Built In Us And Another 2500 If Made In A Unionized Factory R Teslamotors

Tesla Model Y Tax Write Off 2021 2022 Best Tax Deduction

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

The 2021 Tax Credits Will Take Tesla To The Moon Torque News

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Ev Federal Tax Credit Electrek

We Take A Look At The New Ev Tax Credit And Which Teslas Qualify

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore

How Much We Paid For Our 2021 Tesla Model Y J Q Louise

Tesla Ev Buyers Could Qualify For Tax Credits Under New Senate Bill